Since their establishment, legacy financial institutions and their methods have fared very well. However, with the evolution of technology and the adoption of digital transformation, the financial services industry has come a long way. When technology was fused with finance, the change was considered revolutionary enough.

New technologies like Cloud computing, Blockchain technology, Machine learning, Artificial Intelligence, Quantum Communication, RFID technology, Biometric recognition, and several others are coming into the picture. It is crucial to learn how they are transforming the financial services industry and why they are beneficial for the end-users. Banks and fintech enterprises are benefitting from open APIs and fintech megatrends and applications can be further explored. Let us dive more in-depth and have a closer look at the top five technologies transforming the financial services industry.

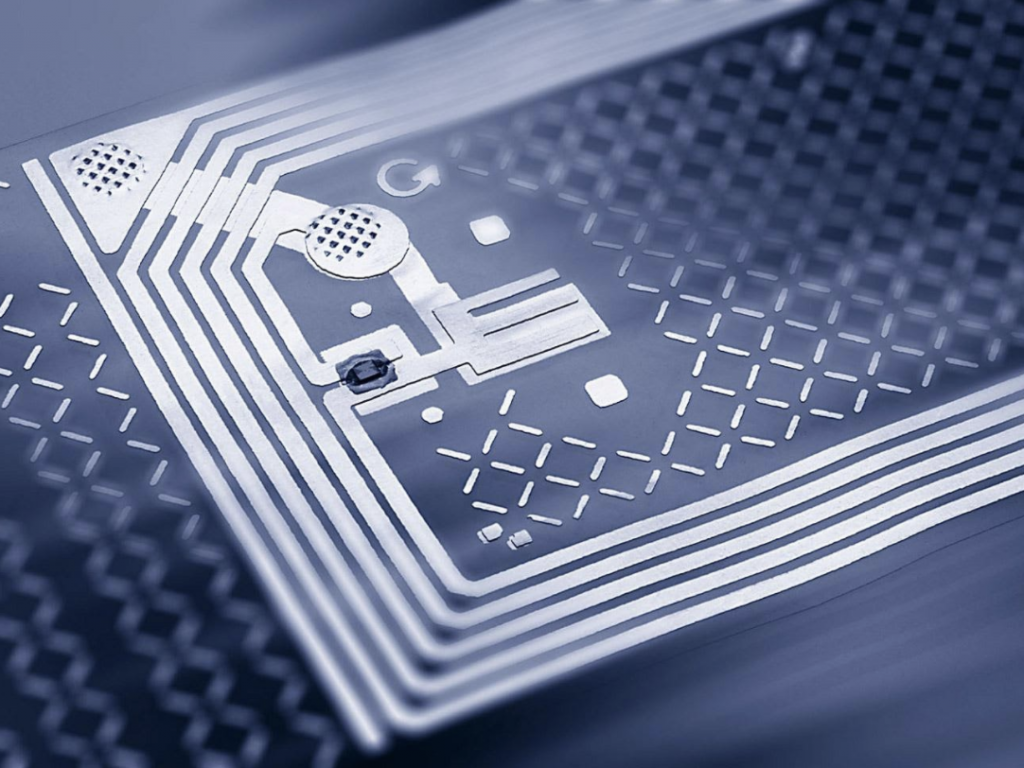

1. Utilization of RFID system components and RFID technology

RFID or Radio-frequency Identification is a technology using which digital assets (data) are encoded and then automatically identified using track tags. The RFID technology has become a crucially vital protection layer used by numerous financial institutions, payment providers, and central banks to safeguard their digital assets. RFID protection is being implemented to protect servers, sensitive and classified company and customer data, laptops, hard drives, and other equipment.

Using RFID security helps these financial institutions automate numerous inventory processes, keep track of their fixed assets, increase capital visibility, boost efficiency and productivity in asset management, and remove errors due to reduced human judgment. RFID system components are also being used by banks to safeguard courier bags in which hard cash or sensitive documents are transferred from one location to the other. Plus, RFID chips embedded in credit or debit cards can even allow customers to make payments by tapping the card without having to swipe it through or wait for systems to come online.

2. Embracing machine learning and artificial intelligence

It has been quite a few years since machine learning and artificial intelligence have been associated with finances. These were among the first technology integrations to take place when it came to the financial services industry. Even though it has been an innovative step towards a transformed future, machine learning and artificial intelligence have a long way to go into creating something revolutionary and game-changing. However, both these technologies have still made quite a lot of difference in the scene.

Fraud prevention using biometric recognition is one of the most crucial advances provided by machine learning and artificial intelligence. Now, along with using OTPs and passwords, customers can also use their fingerprints or facial prints to add additional layers of protection. Artificial intelligence has also enabled financial institutions to carry out risk management and fund prediction, thus becoming essential financial tools for business decision making.

3. Application of Robotic Process Automation

Another crucial application of artificial intelligence as financial tools is the utilization of Robotic Process Automation. There’s no hiding the amount of paperwork and manual processes that take place in a financial institution. These redundant yet essential processes can be taken care of by Robotic Process Automation. Whether it is the maintenance of regulatory documents, extraction of summaries from lengthy business documents, or collecting statistics and numeric values, Robotic Process Automation is a blessing. Plus, since these financial tools eliminate resource wastage and boost productivity, they not only serve as great financial tools to start a business but also as financial tools for business decision making.

4. Increased adoption of Cryptocurrency and Blockchain technology

Cryptocurrency and Blockchain technology, in general, have been under a lot of scrutinies, especially from legacy financial institutions. However, people all across the globe are slowly and gradually adopting cryptocurrency. This has also caused several financial institutions to consider blockchain technology and use it as a sort of regulatory means because of its decentralized nature.

Shortly, blockchain technology is expected to further the cause of transformation of the financial services industry and be used to revolutionize digital and contactless payments, loan authentication and processing, escrow services, and more. Blockchain technology will also be crucial to automate numerous processes bound by regulatory compliance standards.

5. The rise of conversational banking

The most typical queries customers have related to financial services are, in fact, straightforward and repetitive. “How can I block my stolen credit card?” “How can I unblock my card?” “How do I access my online account?” “Where is the nearest ATM?”. “Where is the nearest bank branch?” “How can I start a fixed deposit?”. Instead of a human replying to them every time, conversational banking can help automate the replies to such questions.

By using artificial intelligence and machine learning to create Internet bots or Chatbots, financial institutions can do a lot. They can quickly answer the most simple and common customer queries, walk them through the complete registration process for a service, teach them how to make transactions or withdraw money, and even serve as advisors to track their budget and spending habits. This not only adds ease and convenience to the customer’s life but also optimizes customer experiences.

With increasing usage and flourishing trends of conversational banking as a personalized customer service assistant, the financial services industry will need to hire more neuro-linguists, AI programmers, and voice recognition experts. In the next few years, we’ll also be looking at developing hybrid AI-human models that will give enough control to Internet bots but also enable human agents to step in when required quickly.

Drop us a line at info@ndngroup.com to learn more about how our technologies help expand your business in the era of fintech.